01.03.2010 - 15.03.2010

Spring sales started on the telecommunications market

The news review of the Russian telecommunications market for the first half of March, 2010, allows to conclude that there has been a lot of information on acquisitions and sales of different companies. Below you can find the basic messages devoted to the topic.

| 01.03.2010 | The period during which the Volga region’s mobile operator SMARTS should have been sold to the state-owned holding "Svyazinvest" ended. Representatives of "Svyazinvest" say they haven’t not changed their mind, but they are going to buy the operator when the audit is over. |

| 02.03.2010 | The Finnish company Tieto bought the Russian supplier of telecommunication equipment «T&T Telecom» |

| 02.03.2010 | The group PromSvyazCapital issued an official statement which says that the shareholders of Sinterra, part of the group PromSvyazCapital, are now considering a few possible offers from several participants of the market. The offers differ in price and other parameters Decision on the deal hasn’t been made yet. |

| 02.03.2010 | The Board of Directors of Megaphone LLC approved the purchase of 100% package of "Sinterra" |

| 04.03.2010 | Vympelcom discusses the possibility to sale up to 18% of Morefront Holdings Ltd which owns 100% of Euroset. |

| 04.03.2010 | The talks on the sale of 15 % in Euroset by businessman Alexander Mamut to an undisclosed buyer entered its final step. |

| 04.03.2010 | The president of the Systema Leonid Melamed addressed a letter to VneshEconomBank in which he files a claim of AFK for the shares of SMARTS that are now in pledge at the bank |

| 09.03.2010 | The talks on the exchange of Alisher Usmanov’s shares in Russian company Megaphone for the securities of the state holding Svyazinvest are temporarily stopped |

| 10.03.2010 | The Finnish company Tieto negotiate with TNK-BP the purchase its IT division – TBI |

| 11.03.2010 | Russian railways LLC sent to investment banks the offer to sale its shares in affiliated company TTK during IPO or private offering |

| 12.03.2010 | Leonid Maevsky, the owner of Sigma Capital Partners, accuses AFK System of the attempt to seize the Volga region mobile operator SMARTS, 20% of which belongs to him, and to make Sigma bankrupt. |

| 12.03.2010 | Shareholders of Akado informed the potential buyers of this group — National telecommunications, Megaphone and Svyazinvest that they are waiting for indicative offers from them. |

| 15.03.2010 | Telecommunication holding ER-Telecom searches for the buyer. The operator that planned IPO already in 2008, now considers the possibility to sale shares of the company during the private offering. |

| 18.03.2010 | Sinterra is interested in the operator Multiregion. Now the management and the owners of Sinterra are studying the possibility of the purchase. Akado is also discussed as a possible object for a purchase. |

As it is seen from the table, the big Russian companies are ready to participate in M&A deals. There can be several reasons for the market revival.

Firstly, the end of the financial crisis can be the most obvious reason. The owners who have kept their actives during crisis time, are ready to throw them out to the market now as their value raised considerably. Besides, potential investors are now more confident in the stable development of the Russian economy. As a consequence, we can see the growth of the Russian companies’ shares, including those of the telecommunication sector.

Secondly, the telecommunication market is a very special mechanism that is constantly changing in concordance with quickly developing technologies. At the moment many experts point out that the market entered the phase of the fast qualitative change. For example, Dan Rasmussen, the head of the global division on elaboration and development of telecommunication decisions in Siemens Enterprise Communications Group, says that one of the key trend in the next few years will be “the transition from technological understanding of telephony as a simple service to the more difficult perception of it as the system of unified communications when telecommunication is integrated into the united system with data transmission and video, and is a certain part of information & communication technology (ICT) system of the company”. Alexander Izosimov, the head of VimpelCom Ltd, gave more details about the current development of telecommunication industry during the meeting with journalists in the beginning of March. He said that «now the whole telecommunication industry is on the threshold of the most serious changes and transformation. In 5-10 years the world of the industry will look completely different. Now under the influence of several factors the logic of the industry is changing. The computer world (IP-telephony) breaks into the telecommunication world. Moreover, it comes from the absolutely different side, where telecommunication has difficulties to struggle against it. There are also internal factors inside the industry. The number of customers stops growing. By the end of this year there will be 5 billions of subscribers among 6 billions of people living on the planet. And the cost of 1 minute in most cases approached the “for free” level. The growth of the voice traffic won’t give much. To remain a narrow player in future will mean to be defeated». It’s quite possible that growth of purchases and sales is connected with the wish of the companies’ shareholders to get rid of secondary or unpromising actives to invest financially as effectively as possible now into the development of "the companies of the future”.

The revival of the Russian M&A market was noticed also by big analytical agencies. For example, experts of Finam consider mining and telecommunication sectors to be among the most attractive sectors for the M&A market in 2010.

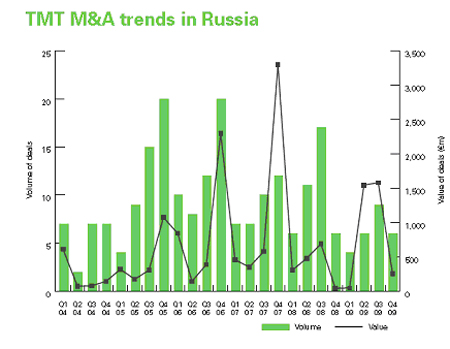

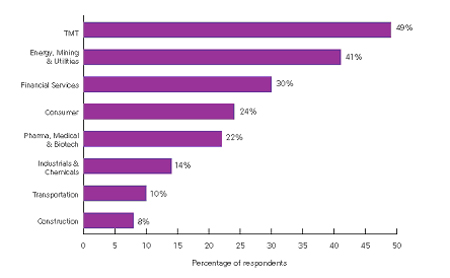

The detailed report, devoted to the prospects of the Russian M&A market in 2010, was prepared by the international juridical company CMS (http://www.cmslegal.com/Deal-Drivers-Russia-03-12-2009). According to the results of the questioning of 100 largest Russian companies’ directors about M&A and the corporate finance carried out by mergermarket and CMS, there has been made the projection of the biggest deals in Russia in 2010. The survey showed that the initiators of the deals are very optimistic about the future M&A market in Russia. They see the main obstacle for the growth of the Russian companies in the next 12 months in severe crediting conditions and lack of liquidity on the market. Almost half of the interrogated directors think that the greatest activity on the Russian M&A market in 2010 will be in the telecommunication sector. 88 % of the respondents believe that the Russian customers will show the greatest activity in Asia-Pacific region. And first of all, their interest will concern telecommunication actives. The picture shows that at the end of 2009 the telecommunication market started to grow.

«As a result of the research we have come to a conclusion that the «bottom» of the financial crisis has already been reached, and in 2010 M&A market will grow and develop, - said John Hemmond, the senior partner and the head of CMS in Russia. - Within a year we are going to see about 200 M&A deals in the country with an average cost of 86 million euros».

In 2010 the M&A market in Russia will start to recover after the fall. According to the majority of the interrogated directors, the greatest activity in M&A sector in Russia will be in telecommunications (ТМТ - telecommunications, media, technologies). Almost a half of the respondents (47 %) believe that big companies which will get rid of secondary actives will become the leaders of the Russian M&A market in 2010. The main financing will come from the banks with state participation.

A lot of news, concerning this topic that appeared in various mass-media, possibly prove that analysts’ assumptions are starting to come true. The telecommunication market outlived the first wave of the crisis and started to grow and change.